NO SURPRISES

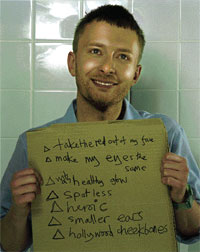

In the Thank You notes on Thom Yorke’s new “solo” album The Eraser, Yorke gives the biggest nod of all not to his wife or his young son, but to his bandmates, saying, “This record would not have happened without Radiohead, and their total faith in me.”

In the Thank You notes on Thom Yorke’s new “solo” album The Eraser, Yorke gives the biggest nod of all not to his wife or his young son, but to his bandmates, saying, “This record would not have happened without Radiohead, and their total faith in me.”The acknowledgement seems less like a gracious love note full of camaraderie, and more like the thanks of a presiding God, who wants his subjects to know that their love has not gone unnoticed. I hear echoes of Colin Greenwood saying (and I papraphrase): “We are like the U.N., but Thom is definitely America.” I doubt, however, that Thom has gotten so excitable in the last few years. Most likely, the attempt at penitence is directed at the fans. Yorke is publicly aware of the concerns his “solo” album raises amongst the populi, and on a message board at W.A.S.T.E., he accompanied an apologetic announcement of his “solo” effort with an unequivocal assertion of the band’s survival:

this is just a note to say that something has been kicking around in the background that i have not told you about. its called The Eraser. nigel [Godrich] produced & arranged it. i wrote and played it. the elements have been kicking round now for a few years and needed to be finished & i have been itching to do something like this for ages. it was fun and quick to do. inevitably it is more beats & electronics. but its songs. stanley [Donwood] did the cover. yes its a record! no its not a radiohead record. as you know the band are now touring and writing new stuff and getting to a good space so i want no crap about me being a traitor or whatever splitting up blah blah . . . this was all done with their blessing. and i don’t wanna hear that word solo. doesnt sound right. ok then thats that.

The dedication still reads with a tinge of arrogance, but at least it is arrogance meant to comfort.

Upon listening, The Eraser affirms Yorke’s claims, and assuages all worry. He has not pulled a Beyonce, and none are forsaken or spited. The nine-track album reveals itself as less of a diversion or experimental work then as a purge of the drone/electro/pop urges that Yorke must have suppressed in the making of the more organically oriented Hail to the Thief. If so, The Eraser may prove vital to the Radiohead’s survival rather than its demise.

Yorke’s album is a tight collection of four and five minute tracks that fit nicely into the Radiohead tradition. As is, nothing here couldn’t be decent b-side, and most are better than “Paperbag Writer” from the “There There” EP. There are no challenging epics, none of the shapeless wandering instrumentals that might be expected, and if Yorke has done something novel here, it is by remaining within his comfortable territory.

Throughout, amorphous major chord soundscapes pivot into eerie minors, and a droney tension dominates. “Analyze” shifts so seamlessly that it is hard to realize that you are dancing to a dirge, and “Harrowdown Hill” makes a similar move from troubling-industrial to melodic love song. Tracks expand in electronic layers over flea-circus percussion that holds the beat on every track. Yorke croons in the

background, while many of the frontal melodies are clean and articulate - a little shocking until you realize that this is the same guy who made The Bends and Pablo Honey, and is no stranger to straightforward singing. “Black Swan” ventures into a bit of funkiness and accounts for the EXPLICIT LYRICS warning on the cover, and “Atoms For Peace” may be the most innovative track of all, presenting a Thom Yorke inversion in which all the sounds are comforting and all the lyrics are un-ironic pick-me ups: "no more talking 'bout the old days/it's time for something great".

background, while many of the frontal melodies are clean and articulate - a little shocking until you realize that this is the same guy who made The Bends and Pablo Honey, and is no stranger to straightforward singing. “Black Swan” ventures into a bit of funkiness and accounts for the EXPLICIT LYRICS warning on the cover, and “Atoms For Peace” may be the most innovative track of all, presenting a Thom Yorke inversion in which all the sounds are comforting and all the lyrics are un-ironic pick-me ups: "no more talking 'bout the old days/it's time for something great".The opener and title track is the best track of the bunch, which may or may not have something to do with the presence of Johnny Greenwood, who plays the two Messiaen inspired chords that open the album. “The Eraser” is Yorke at his best: quietly aggressive, blippy, with occasional vocal explosions, and a familiar-enough beginning that evolves steadily into an electronic malaise, the exact metaphor that Yorke has been trying to hammer home since they decided on the name OK Computer.

Conclusions about The Eraser will depend on what allowances listeners are willing to grant Mr. Yorke. These songs are not wonderful, but they are not in any way bad, or self-indulgent, or lazy, or any of the other standard mistakes that newly solo band leaders tend to make. Yorke is doing what any artist is entitled to do, which is to make music that he loves without concern for much else. I personally enjoy seeing that happen, and like that Yorke enjoys his drone/electro/pop more than he enjoys the innovation and experimentation that have become his band’s hallmark. The Eraser merges nicely into the catalog and becomes a pleasant aspect of a larger body of work.

On the other hand, one might argue that Yorke is being lazy, that he took a collection of tracks with great potential and gave them a half-ass treatment in a self-serving vanity project. The album will come as a disappointment to listeners who expect Yorke (and co.) to re-invent with each new outing. It is not hard to spot the missing elements, and we can only dream of what mutations would have taken place had these moved from Thom’s laptop to a proper recording session.

I am not sure I could – or should – convince you one way or the other. In the end, the answer will have to depend on your own faith in Thom Yorke.